Ranplan CEO Insights Part 1 – Telecom Transformation of 2026+: AI-Native Networks, Airborne Connectivity & 5G to 6G Evolution

The telecom industry is entering its most transformative period in decades. Contextual AI, airborne connectivity, and next-generation architectures are converging to fundamentally change how networks are designed, operated, and monetised. As we approach 2026, the shift from cloud-native to AI-native systems signals a new era — where intelligence is embedded by default, adaptability occurs in near real-time, and performance — translating into user experience — becomes predictive rather than reactive.

Optimism Reignited by AI and Airborne Technology

After years of stagnation, the telecom sector is showing renewed momentum, driven in large part by advances in AI and a maturing ecosystem of airborne communication platforms. Technologies such as AI-RAN allow MNOs to harness GPU computing and extract significantly greater value from existing infrastructure, reopening a path to sustainable revenue growth beyond pure connectivity. In parallel, progress in drones, satellites, and high-altitude systems is reshaping the economics of flexible coverage. As we move into the second half of the decade, investments will increasingly prioritise programmable, self-automated networks capable of responding proactively to shifting user demand in space and time.

MNOs must leverage technology to return to a path of profitable organic revenue growth

Courtesy of Acropolis, see AI RAN Initiative | AcropolisDocs.

ICT Transformed by Massive Investments in Computing and AI

The enormity of investment flowing into GPUs, data centres, and AI applications easily dwarfs the dot-com era and will profoundly reshape both society in general and the ICT sector in particular. Ongoing and projected developments will unleash entirely new applications and services, catalyse unparalleled productivity improvements (without compromising accuracy and quality, if implemented correctly), and impose far stricter requirements for network cost-efficiency, reliability, resiliency, and security. Machine-to-machine and machine-to-human communication will be catapulted to levels previously unimaginable, impelling carriers to rethink network design, assurance frameworks, and lifecycle management metrics.

Forthcoming step-changes in computing power will profoundly influence the ICT industry

Quality Assurance Becomes Even More Indispensable

AI-native assistants and copilots will democratise access to deep domain knowledge and its practical application, enabling non-experts to leverage capabilities once reserved for seasoned professionals. By lowering the barriers that traditionally inhibit or slow those less experienced, these systems can identify solutions, execute tasks, and even surface new possibilities as requirements evolve.

This expanded accessibility, however compelling, makes quality assurance more critical than ever. Without it, AI-generated guidance may appear plausible while containing subtle but consequential flaws—often described as hallucinations. Early experience also shows that outcomes remain highly sensitive to how questions are framed. As AI becomes incorporated in real operational workflows, accuracy, domain grounding, and data integrity will be more essential than ever.

Domain expertise is poised to become absolutely critical in the era of pervasive AI

Lessons Learnt from the 5th Generation

While 5G has yet to fully meet initial expectations, it has clearly demonstrated the value of standalone cores and network slicing. These capabilities enable operators to differentiate services, unlock new revenue streams, and optimise both spectrum and physical network resources. Private wireless—arguably the most attractive revenue opportunity —benefits especially from enhanced customisation.

This generation of cellular technology also reinforces a consistent pattern: higher investment levels correlate strongly with improved competitive positioning. Across generations, one lesson remains unchanged—breakthrough technologies must be adopted early to deliver advantage. The telecom sector has historically lagged IT in this respect, and delayed adoption has repeatedly eroded competitiveness. Timely uptake will therefore be a decisive factor in shaping future market leadership.

Breakthrough technology must be embraced and deployed in a timely fashion, without protracted delay

Centimetre Waves Enter Centre Stage

Spectrum planning for 6G is taking a more prudent and pragmatic approach. Contrary to the early days of 5G that relied on millimetre-wave bands, the focus has shifted to the centimetre spectrum (7–15 GHz) as the bedrock for mainstream 6G deployment. Higher frequencies, including the so-called sub-THz band, will be devoted to use cases where extreme capacity or ultra-low latency justifies the costs associated with network densification, ubiquitous coverage, and, not to be overlooked, specialised chipsets, sensors, and devices.

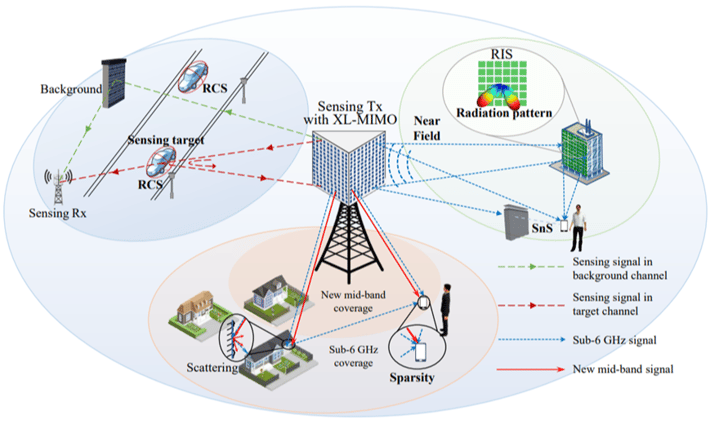

Emerging technologies like Reconfigurable Intelligent Surfaces (RIS) may enhance the viability of mmWave frequencies in the 2030s, particularly for in-building environments. Preparatory steps for seamless migration from 5G and 5G Advanced are expected in 2026, with full-scale 6G deployments anticipated roughly five years later. Such a measured approach reflects a shift toward cost-effective, reusable, and scalable network planning processes and workflows.

Simplicity must be a virtue forever – 5G proved overly complex and insufficiently streamlined

6G as an Evolution of Standalone Architecture

Unlike early 5G, there is little ambiguity around the 6G core. It is widely expected to build on the same principles as 5G standalone—an architecture that, even five years into the current generational cycle, is still not broadly deployed nationally, limiting the delivery of some of 5G’s most visionary benefits, such as edge computing and network slicing.

6G aims to address areas that remain unfinished in 5G, including self-adaptive networks powered by intelligent radio controllers, ultra-low-latency support for industrial applications, and advanced airborne platforms enabled by recent breakthroughs in drones and satellite technology.

In practice, 6G is designed to unlock these new capabilities without fundamentally departing from the core of standalone 5G. It is therefore expected to be seen as a natural evolution of the existing architecture rather than a disruptive break, combining continuity with meaningful enhancement.

Source: ISAC – Integrated Sensing and Communication in 6G

The standalone architecture should hereafter be widely accepted as the common core

Airborne Vehicles Connect Wireless to the Skies

Recent advancements are bound to have a lasting impact on the telecoms sector. Airborne vehicles—whether used for surveillance, on-demand sensing, or as temporary base stations moving in the skies —will play an increasingly important role in real-time information gathering, location and mapping services (including real-time collected digital twins), and provision of temporary network augmentation.

Operating just a few hundred metres above ground, these platforms complement terrestrial networks and strengthen responses to emergencies, uplink-intensive scenarios, and large public events. For example, a drone could be dispatched automatically to provide additional uplink capacity at the site of a natural disaster, car crash, or major security incident. Paired with Wi-Fi hotspots, airborne platforms can overcome the limited coverage of fixed access points, extending connectivity where it is needed.

In the future, mobile networks will be mobile in more ways than before

From Data Centers to Shared Intelligence via Connectivity

Despite the progressive decoupling of software from hardware, there is little doubt that the two elements continue to evolve in a largely symbiotic fashion–each advancement spurs progress in the other. The journey from the first data centres in the 1950s to today’s cloud-native, AI-influenced mega server facilities is a clear illustration of this virtuous cycle. More powerful hardware enables more sophisticated software; more advanced and enriched software, in turn, demands ever more capable hardware. A self-reinforcing loop is set in motion.

Even in a world of disaggregation, hardware and software will still evolve symbiotically

Soaring demand for data centre interconnects is revitalising the fortunes of optical fibre manufacturers, long seen as commodity suppliers. Yet this tidal wave of traffic will inevitably create bottlenecks elsewhere, especially across both wired and wireless telecom infrastructure. Mobile networks, still the primary conduit for global internet access, will need to adapt not only to higher traffic volumes but also to far greater variability, especially on the uplink, already strained by a surge of image and video uploads.

Mobile networks will have to handle much greater and more variable traffic in both the downlink and uplink

From Cloud-Native to AI-Native

Just as cloud-native stole the limelight in early 5G thinking, AI-native stands out as essential for the commercial arrival of 6G. What this means in practice over the next 10–20 years is still evolving — networks cannot be transformed overnight, and mission-critical infrastructure must undergo rigorous scrutiny — but the principle is clear: future systems will embed AI deeply into their fabric. This shift promises significant gains across such diverse fields as energy efficiency, spectral management, network adaptability, performance, and utilisation.

AI-Native design also paves the way for distributed data centres at the edge, co-located and increasingly integrated with RAN processing units. These developments will lead to shorter response times (lower latency), allowing service providers to meet the demands of advanced private wireless use cases (such as smart cities, factories, and warehouses). They will also help operators differentiate beyond basic connectivity, unlocking new monetisation opportunities in local compute power, enhanced security, and improved service assurance.

Effective realisation of AI-native hinges on the widespread adoption of open file formats

Priorities for the Years Ahead

As AI, airborne systems, and next-generation architectures mature, telecom networks will evolve from static infrastructure into adaptive, intelligent platforms. The years ahead will reward operators and technology providers that embrace these shifts early, invest in openness, and prioritise quality assurance at every layer. The transformation is already underway—and those who prepare now will define the industry’s next decade.

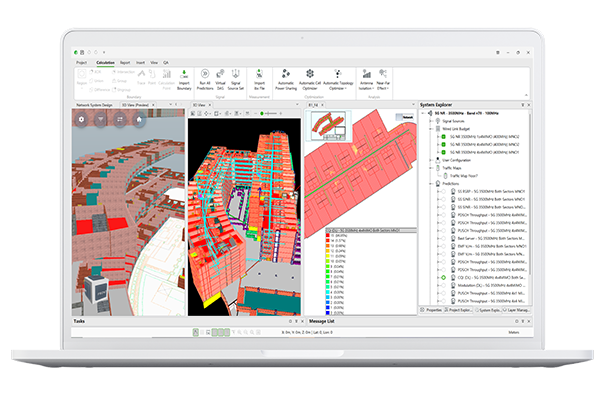

Discover the advanced features of Ranplan Professional and elevate your network planning to new heights