Ranplan Group AB - Interim Report January - June 2025

Stockholm, Sweden - 31st July 2025 08:00 CET

The period in summary

First half of 2025 (first half of 2024)

- Total income amounted to SEK 12.8 million (14.0 million)1

- Net sales amounted to SEK 6.9 million (6.6 million)

- Total revenues amounted to SEK 10.8 million (11.3 million)

- Operating income amounted to SEK -8.1 million (-5.5 million)

- Net income amounted to SEK -9.4 million (-6.6 million)

- Earnings per share amounted to SEK -0.17 (-0.14)

- Cash flow from operations amounted to -SEK 8.3 million (-3.6 million)

- Cash at the end of the period amounted to SEK 3.9 million (2.4 million)

- At the end of June 2025, SEK 50 million of the credit line was unutilised.

Notes:

1 Total income comprises the sum of net sales (related to commercial products and services), other income (associated with research projects) and other operating income (derived from R&D tax credits). Total revenues comprise the sum of net sales and other income.

Significant events in the first half of 2025 and year-to-date

- On 8th of April 2025, Ranplan announced that it intends to issue 30 million new shares; external investors were invited to take part in 60% of the total share issue, on the same terms and conditions as a set-off issue; Ranplan Group AB intends to issue thirty million new shares

- On 9th of May 2025, the Annual General Meeting for 2024 was held in Stockholm, Sweden. Annual general meeting held in Ranplan Group AB (publ)

Words from the CEO

On a fixed currency basis, total revenues were broadly stable in the first six months of the year. Net sales, comprising commercial products and services, advanced by 5% in SEK in comparison with the year-earlier period and by approximately 10% after adjustment for the stark appreciation of the SEK versus the USD. Other income, drawn from research projects carried out on behalf of government institutions in the EU and UK, shrank by around a sixth as a direct effect of the completion of a proportion of last year's ongoing assignments. With inclusion of tax credits tied to R&D activities, diminishing in line with prior expectations by around a quarter (owing to more stringent qualifying criteria), total income declined in the single digits.

The loss from operations rose to SEK 8.1 million, representing around sixty percent of R&D investments - all of which were expensed in the income statement with no capitalisation of assets on the balance sheet. A modest increase in operating expenditures and negative translation effects of working capital (net of receivables and payables) contributed to the development. Cash flow from operations, including a slight build-up of working capital (versus a marked reduction in H1 2024), amounted to -SEK 8.3 million (-SEK 3.6 million in H1 2024). The difference of SEK 4.7 million is largely accounted for by timing differences with respect to the collection of tax credits (which can happen on either side of the calendar mid-year).

In the first six months, we landed contracts with more than ten new customers and renewed maintenance and support agreements with the chief majority of our existing base of active users - both testaments to a high level of client satisfaction with our products and services, which ought to set the scene for 'word-of-mouth' in a closely knit community of engineers devoted to perfecting the design of wireless networks. The pipeline of business prospects also continued to expand with new interesting opportunities emerging in most parts of the world. We take great pride in making our customers successful in the marketplace. In this regard, it is highly gratifying that a recent public announcement in the UK related to the nationwide railway sector affirms that the choice of our software does pay dividends.

Still in its infancy, private wireless constitutes one of the fastest growing telecom segments where demand is gathering steam. We are actively involved in a whole variety of projects revolving around e.g. remote control of machinery in mines, capacity simulation in arenas and stadia, and multi-technology connectivity within ships. In a confidence-building move, we most recently published an enlightening case study which highlights how offshore windfarm companies can take advantage of our capabilities and expertise to ensure reliable and safe communication across the complete territory of their operations, including the central platform itself. In future, we anticipate share gains as the private wireless segment enters a phase of scale replication of use cases where our solutions have proven to be best-in-class.

Encouraged by the feedback we received from leading customers, we have intensified marketing campaigns with active participation in a record high number of conferences and events so far in 2025. These activities serve to cement existing relationships, establish new important ones and raise general awareness of our capabilities within the fields of both commercial products and services and research orientated undertakings (for academic institutions and enterprises). Though sales cycles tend to prolong over periods of several months, we believe that these investments will pay off over the course of the next few years. In parallel, we seek to add highly motivated and demonstrably proficient resellers to our existing collection of close to a dozen locally entrenched go-to-market affiliates. The sheer robustness of our products with distinct points of positive differentiation makes us an increasingly attractive partner.

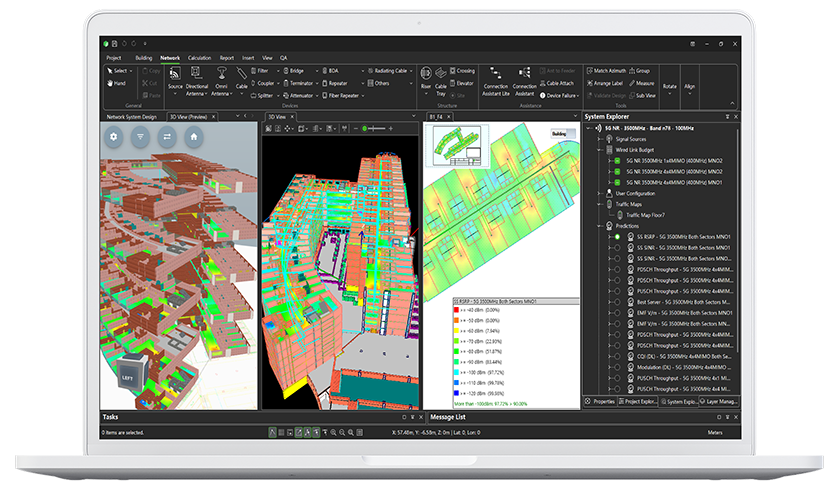

In the beginning of April, a new version of our software was made commercially available. Through this release, we introduced a number of enhancements that fortifies our leadership with respect to inter alia (1) the user interface in full 3D; (2) the introduction of re-useable BIM (Business Information Modelling) elements; (3) the flexible control of BIM-to-IFC (Industry Foundation Classes) conversions; (4) the versatile mounting of devices; (5) the automation of labelling and routing of cables, and (6) the ability to increase the speed of simulations and track compliance standings. Towards the end of the period, we also launched an academic version of our flagship product Ranplan Professional that is aimed principally at universities and colleges. A research module dedicated to modelling reconfigurable intelligent surfaces (RIS) - a prime ingredient in future generations - further broadens the breadth and depth of our enlarged offerings.

Following completion of the most recent set-off issue, raising SEK 36 million before negligible transaction costs, the balance sheet has been substantively bolstered. This move in May, to which external investors were invited to participate on the same terms and conditions as the debtholder, affords the company greater flexibility in selectively expanding its operations on a case-by-case basis without, importantly, compromising the most pertinent of criteria - a satisfactory return on investments with due attention paid to risks and uncertainties. It frees up 100% of the existing credit line (with an upper limit set at SEK 50 million), ensuring access to additional liquidity until at least 1 March 2026 (the current expiration date).

These remarks notwithstanding, our unwavering aspiration is to attain and sustain self-funding from operations in the first instance and a healthy cash surplus in the second. With software gross margins a shade below the 100% mark, it would not take more than some USD 2 million in incremental sales for us to reach if not surpass cash break-even. We also continually look for cost savings and efficiency gains.

Although exogenous factors continue to hamper investment appetites, we take comfort in the value creations of our innovative offerings encompassing products, research and services which all serve to help our customers obtain material gains in terms of both cost-efficiency (through tangible productivity gains) and performance enhancements (quality and reliability of wireless connectivity). Looking beyond current technologies, we are already setting the scene for the next generations, spearheaded by 6G and new incarnations of WiFi (as well as any combinations thereof). Our pedigree in driving research projects at the absolute frontier of the industry clearly has the capacity to be extended to other groups of clients in the coming years. Provision of design services using external and/or internal resources has been well received. This additional leg serves as a complement to our core licensing business model.

Commercial discipline and operational effectiveness remain at the epicentre of our corporate ethos, defining our character, guiding principles and values. In alignment therewith, our strategic decisions will be directed at expanding the scope of our activities in areas - whether existing or prospective ones - where there is clear impetus for underlying growth and where we can lever tangible competitive advantages to the benefit of stakeholders. We will champion open file formats in the spirit of BIM demonstrate the inherent benefits of a holistic approach to wireless network design, set new standards for accuracy, productivity and useability and embrace collaborations with 3rd-parties on mutually synergistic grounds.

For further information, please contact:

Per Lindberg, CEO

Tel: +46 79 340 7592

per.lindberg@ranplanwireless.com

Certified Adviser

beQuoted AB is the Company's Certified Adviser at Nasdaq First North.

info@bequoted.com

Ranplan Wireless pioneers software solutions for the design, optimization and simulation of in-building and urban outdoor wireless networks. Supporting a wide range of technologies-including 4G LTE, 5G, Wi-Fi, IoT, TETRA, and P25-our solutions enable an ecosystem of companies to deploy next-generation wireless networks for diverse applications. Our open platform, intelligent automation, and 3D ray-tracing simulations streamline the network planning process, expertly identifying potential issues and optimizing network performance for reliable connectivity. This results in an unparalleled quality of service, ensuring seamless and efficient wireless communication for end users and businesses. For more information, visit www.ranplanwireless.com.

Ranplan Wireless is a subsidiary of Ranplan Group AB (Nasdaq First North: RPLAN) whose head office is in Stockholm, Sweden. The group operates out of offices in the UK, USA and China.

Explore the power of precise and efficient network design with Ranplan Professional