Ranplan Group AB Completes IPO and Plans Nasdaq Listing

The subscription period for subscription of new shares in Ranplan Group AB (“Ranplan” or the “Company”) in connection with the planned listing of the Company’s shares on Nasdaq First North Stockholm was completed on 8 June 2018. The offering was fully subscribed, of which the guarantee consortium, excluding subscription commitments, subscribed for approximately SEK 38 million. Ranplan is therefore funded with SEK 62 million before transaction costs.

Not for publication, distribution or release, directly or indirectly, in or into the United States, Australia, Canada, Japan, South Africa or any other state or jurisdiction in which such measure would be unlawful or require additional registration or any other actions to be taken in addition to the requirements under Swedish law. See also the important information section below.

The proceeds will predominately be used for sales and marketing but also for product development and strengthening the Company’s balance sheet.

– It is with great pleasure that we welcome over 600 new Ranplan shareholders, including Per Lindberg, who becomes one of the Company’s majority shareholders, as well as a number of employees at Ranplan. Seeing our employees invest in the Company demonstrates their long-term belief in the business and reinforces my belief that we are on the right track. We are implementing the planned listing of Ranplan in order to strengthen the Company’s position in the market and I am looking forward to taking Ranplan to the next level in the Company’s development, said Alastair Williamson, CEO of Ranplan.

The first day of trading is scheduled for 28 June 2018, subject to approval from Nasdaq First North Stockholm. Subscribers who have been allotted shares will be notified of their allocation in the form of a written contract note sent out in the next few days.

After the new share issue has been registered with the Swedish Companies Registration Office, the total number of shares in Ranplan will increase by 6,019,418 shares from 14,098,394 shares to 20,117,812 shares and the share capital will increase by SEK 240,776.72 from SEK 563,935.76 to 804,712.48, corresponding to a dilution of approximately 29.9 percent.

Advisers

Naventus Corporate Finance AB were financial advisers in connection with the offering and Setterwalls Advokatbyrå AB were legal advisers to the Company in connection with the offering. Hagberg & Aneborn Fondkommission AB has been appointed as issuing agent. FNCA Sweden AB will be the Company’s Certified Adviser at First North.

About Naventus Corporate Finance AB

Naventus Corporate Finance is an independent privately-owned financial adviser offering services in the field of qualified advice on initial public offerings, capital raisings (equity as well as debt), ownership changes, acquisitions, mergers and divestments (M&A) to listed and private companies and its owners.

For more information:

Alastair Williamson, CEO

Alastair.Williamson@ranplanwireless.com

ranplanwireless.com

Important information

This document has not been approved by any regulatory authority. The document is a press release and not a prospectus and investors shall not subscribe or purchase securities referred to in this document except on the basis of the information contained in the prospectus approved by the Swedish Financial Supervisory Authority (Sw: Finansinspektionen) and made available on the Company’s website. Distribution of this press release may in certain jurisdictions be subject to restrictions by law and persons who have access to this, or part of this, are required to inform themselves of, and comply with, such legal restrictions. Information in this press release shall not constitute an offer to sell shares, or a solicitation of any offer to purchase shares, nor shall there be any sale of the securities referred to herein, in any jurisdiction where such offer, solicitation of any offer to purchase, or sale would require preparing an additional prospectus or other offering documents or would not be lawful without registration or applicable exemption from registration under the securities laws of such jurisdiction. This press release does not constitute, or is part of, an offer or a solicitation of an offer to purchase or subscribe for securities in the United States. Securities referred to herein have not and will not be registered in accordance with the US Securities Act of 1933 (Securities Act) and may not be offered or sold within the United States without registration in accordance with the Securities Act, or an exemption therefrom. Securities referred to herein are not offered to the general public in the United States. Copies of this press release are not made and may not be distributed or sent, in whole or in part, directly or indirectly, to Australia, Hong Kong, Japan, Canada, New Zealand, Switzerland, Singapore, South Africa or the United States or to any other jurisdiction where the distribution or issuance of this press release would be unlawful.

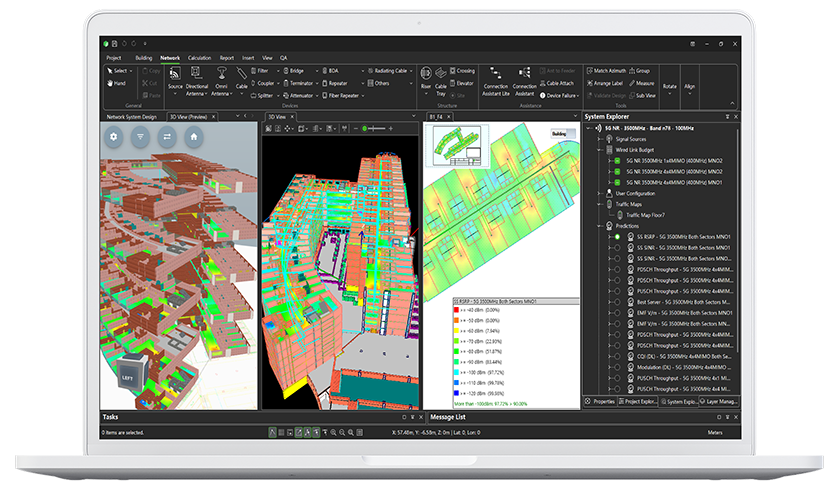

Explore the power of precise and efficient network design with Ranplan Professional