The period in summary

Second half of 2022 (second half of 2021)

- Total income amounted to SEK 15.1 million (14.9 million)1

- Net sales amounted to SEK 9.7 million (7.0 million)

- Operating income amounted to SEK -12.6 million (-12.3 million)

- Net income amounted to SEK -13.0 million (-13.3 million)

- Earnings per share amounted to SEK -0.43 (-0.49)

- Cash at the end of the period amounted to SEK 5.1 million (17.4 million)

Full year of 2022 (Full year of 2021)

- Total income amounted to SEK 29.0 million (32.3 million)1

- Net sales amounted to SEK 17.7 million (15.3 million)

- Operating income amounted to SEK -26.4 million (-21.9 million)

- Net income amounted to SEK -26.7 million (-23.9 million)

- Earnings per share amounted to SEK -0.88 (-0.93)

- Cash at the end of the period amounted to SEK 5.1 million (17.4 million)

- The Board proposes that no dividend be paid for 2022 (no dividend)

- At the end of 2022, SEK 38.7 million was undrawn from the credit line.

Significant events in 2022

- On 23 February 2022, Ranplan Wireless announced that it has been selected by CommScope Inc to upgrade the vast majority of its existing suite of Ranplan Professional licenses, acquire Ranplan Tablet licenses and obtain Ranplan training for a group of engineers.

- On 10 March 2022, Ranplan announced that it pauses business activities in Russia until further notice.

- On 16 May 2022, at the AGM in Stockholm, it was resolved that Tomas Isaksson be re-elected as chairman, and that Jie Zhang, Wendy Yang and Jon Ullmark be re-elected as ordinary members of the board.

- At the end of June 2022, Ranplan Wireless launched the latest version (6.6) of its flagship product PRO.

Significant events after the end of 2022

- On 14 February 2023, Ranplan Wireless announced a reseller partnership with solution provider for radio communications and spectrum management, LS telcom, headquartered in Licthenau, Baden, Germany.

- On 16 February 2023, Ranplan Wireless announced a preview of a feature for ultra-reliable, low-latency applications that will be presented at the Mobile World Congress (MWC) in Barcelona (27 Feb – 2 March).

1 Total income comprises the sum of net sales (related to commercial products and services), other income (associated with research projects) and other operating income (derived from R&D tax credits).

Words from the CEO

Despite continued headwinds from external factors, net sales drawn from commercial products and services grew by nearly 40% year-on-year in the second half of 2022. The healthy rebound helped mitigate reduced contributions from research-related activities. Thanks to solid cost control, losses from operations were more contained than in the first six months of the year and noticeably lower than in the year-earlier period after screening out the effects of certain one-time items and material foreign exchange movements.

The pipeline of research projects, notably, was significantly rebuilt following a tepid patch in 2021. Income from this source may well offset the negative impact of the UK Autumn Statement 2022, see page 15.

We ended 2022 with a cash holding of SEK 5.1 million which together with other net current assets and unutilised funds from the credit line provided us with more than SEK 50 million in payment capacity – affording us sufficient liquidity, barring any disruptive events, to fund operations through calendar 2023.

Operationally, considerable progress was registered in 2022. Our customer base in Japan was expanded to nine (9) enterprise customers (many of whom are well-known household names) which have chosen to employ Ranplan’s suite of tools for the perfection and realisation of advanced industrial applications – illustrating most conclusively domains where 5G catapults the capabilities of previous generations of cellular and Wi-Fi. After an extensive period of work, we successfully completed the final phase of a cloud-native project through which our software elements are integrated into a platform of a leading customer.

Though hampered by pandemic-related anxiety throughout the year, our commercial engagements in mainland China remain robust. We are currently involved in several important projects at the absolute frontier of industry development in close collaboration with a couple of the top mobile network operators/neutral hosts. Automation of processes, design efficiency and performance assurance (audit functions/centralised evaluation systems) constitute concrete customer benefits that we make happen.

In North America, we captured the attention of one of the world’s top three manufacturers of mobile network equipment, resulting in a breakthrough accord which we hope can generate follow-on orders. In the UK, we extended commercial relationships with a series of customers and secured a number of new research projects. In Germany, we transformed a lease into a perpetual license for one of the world’s two largest vendors of radio network equipment. In Italy, we received our first order from a government client. On the reseller front, we recently formalised an agreement with LS telcom AG (Public Company) for the distribution of our suite of software tools to the German-speaking parts of Europe on an exclusive basis.

The quality of our products, last but not least, continues to win accolades from customers worldwide. We see steady improvements on this vital point as the direct result of concerted internal efforts from our dedicated teams within inter alia product management, software development, testing and pre-sales and support to comprehensively and systematically address any critical difficulties that users may experience. Productivity, the ease and speed with which engineers can carry out projects, is another area where we indeed excel. A few field trials conducted in 2022 suggest up to 2x efficiency gains vis-à-vis an incumbent.

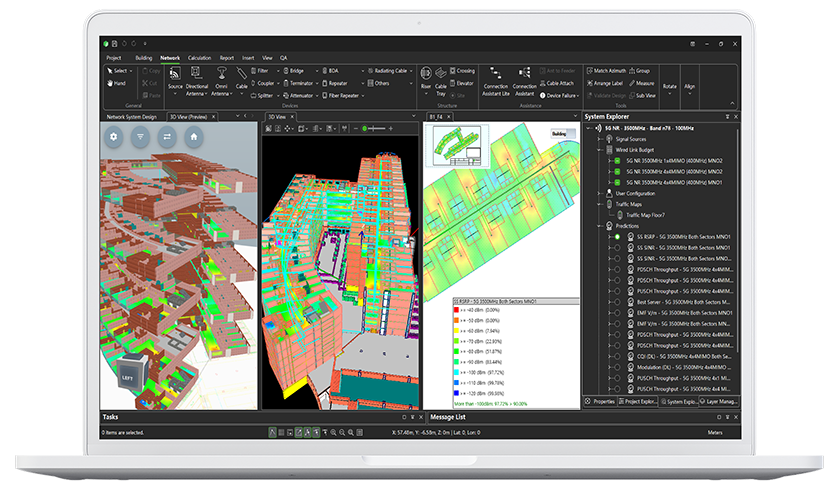

Private Wireless, whilst evolving more slowly than anticipated in 2022, remains our focal point. This is a segment where our expertise and experience come to the fore. It is indoor-centric in nature; it requires absolute accuracy of prediction and reliability of connectivity; it necessitates precise design and utmost attention to the minute control of negative interference between the private and the public network domains; it triggers a desire to leverage our tools – specifically and uniquely coded to handle the indoor and the outdoor seamlessly using the very same algorithms (logic) within a single, unified user interface. Demonstrable traction in Japan, known for its devotion to automation and proficiency in manufacturing, leads the way. The Smart Factory of the future, paving the way for Industry 4.0, is exhibited on p. 12-13.

Momentum is building in this space, aided by the provision of swathes of dedicated frequency resources, continual enhancements to existing 5G standards (revolving around latency, reliability, and security), and periodic releases of entirely new ranges of networking gear, devices and sensors (IoT). Its premium value fuels immense interest from an eclectic group of players, mobile operators, equipment vendors, neutral hosts, web-scale giants, system integrators, major enterprises as well as local and national authorities. Our software, specifically built to handle the most advanced of use cases, fits very well into this picture.

Perspectives 2023

In 2023, we aspire to further bolster our attractiveness, competitiveness, and innovativeness across a whole range of offerings. We expect to benefit from the lifting of pandemic-restrictions in mainland China, setting the stage for a return to face-to-face meetings, project completions and investment recoveries. We envisage broader recognition of the advantages of using our products and services for the refinement and perfection of industrial applications with the success in Japan spreading to other manufacturing centres of excellence worldwide. We project that income from Research Projects will expand significantly in 2023 (from a low base of comparison in 2022), offsetting an expected reduction of income from tax credits from 2024. No cash effect due to this factor is predicted in calendar 2023, but, if the state of current matters stands, then – ceteris paribus (all else equal) - we expect a negative effect of c. GBP 240k (c. SEK 3 million) in calendar 2024 and c. GBP 320k (c. SEK 4 million) in 2025 (in comparison with 2023).

Finally, I want to sincerely thank all customers, partners, shareholders and the whole spectre of our workforce. The storms of the last three years have been weathered in no small part because of the aptitude and fortitude that have been displayed. Such traits instil confidence for the years ahead. Recent success in Private Wireless lends credence to our value provision. To speed the pace of commercialisation, we will strive to forge relationships which are complementary, incremental and supportive to our existing resources, and broaden and deepen our marketing and sales activities. As an avid supporter of open file formats and application protocol interfaces in a multi-vendor setting, Ranplan has the capacity to make advanced architectures, platforms and systems more efficient, functional, intelligent, reliable and robust.

Per Lindberg, CEO

The complete report is attached to this press release and is available at www.ranplanwireless.com

The information in this press release is such that Ranplan Group AB (publ) is required to publish pursuant to the Securities Market Act. The information was provided by the contact person for publication on 24 February 2023 at 08:00 CET.